Renters Insurance in and around Cottage Grove

Your renters insurance search is over, Cottage Grove

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

There's a lot to think about when it comes to renting a home - parking options, outdoor living space, utilities, townhome or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Your renters insurance search is over, Cottage Grove

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects the things inside the place you call home with coverage. In the event of a break-in or a theft, some of your most treasured items may have damage. Without insurance to cover your possessions, the cost of replacing your items could fall on you. It's scary to think that in one moment, the unexpected could wipe out all you've invested in. Despite all that could go wrong, State Farm Agent Nate Pica-Anderson is ready to help.Nate Pica-Anderson can help offer options for the level of coverage you have in mind. You can even include protection for valuables beyond the walls of your home. For example, if your personal property is damaged by a fire, a pipe suddenly bursts in the unit above you and damages your furniture or your bicycle is stolen from work, Agent Nate Pica-Anderson can be there to help you submit your claim and help your life go right again.

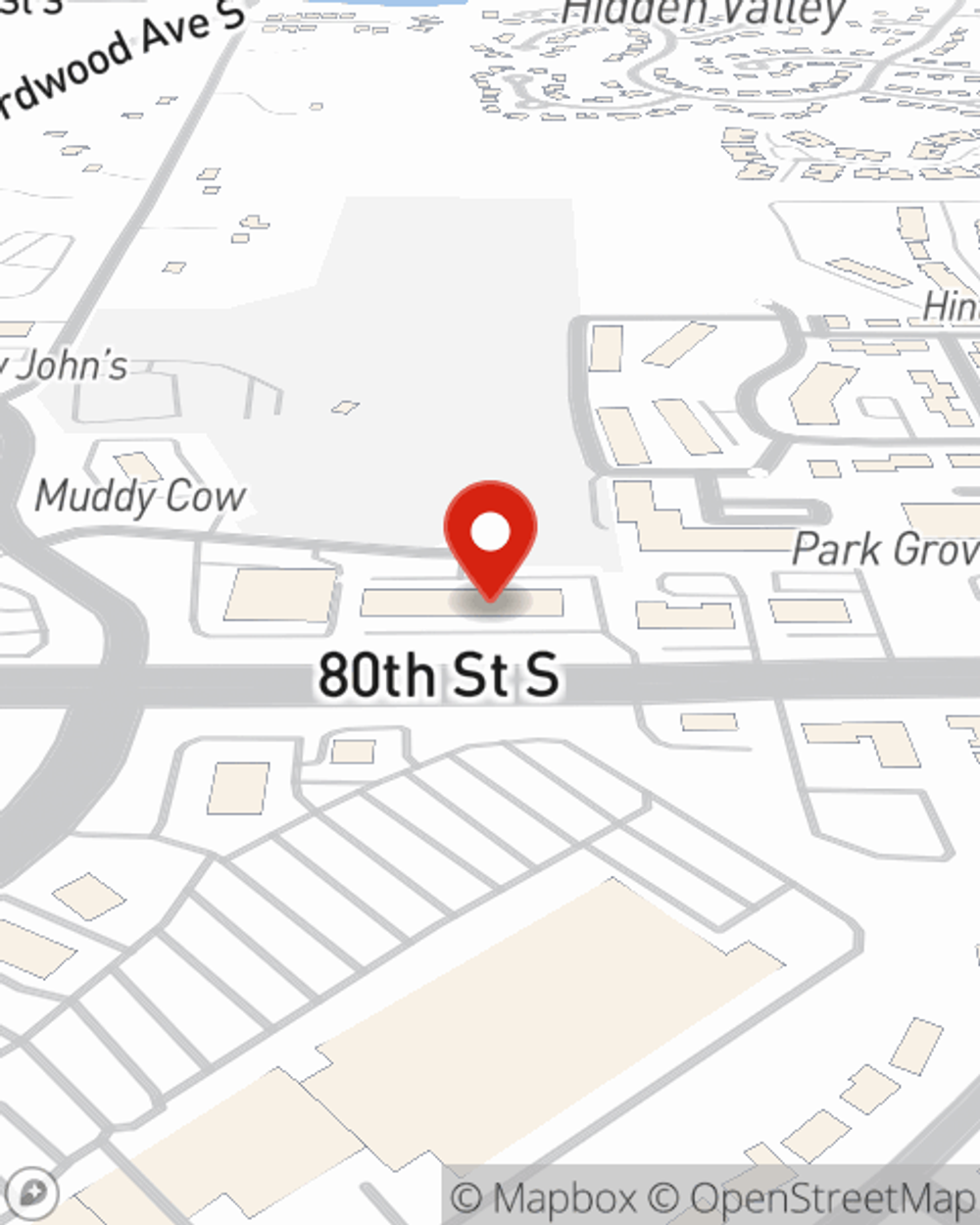

Renters of Cottage Grove, State Farm is here for all your insurance needs. Contact agent Nate Pica-Anderson's office to get started on choosing the right coverage options for your rented property.

Have More Questions About Renters Insurance?

Call Nate at (651) 365-2343 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Nate Pica-Anderson

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.